December 22, 2025

An overview of the PJM 2027/2028 BRA Results

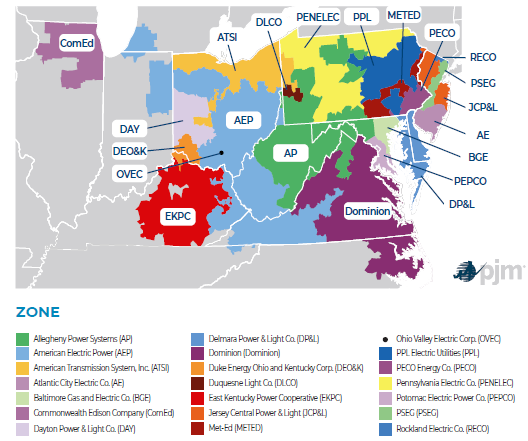

PJM posted the results of its 2027/2028 Base Residual Auction (BRA) on December 17, 2025. As widely expected, the auction cleared at the price cap of $333.44/MW-day across the RTO.

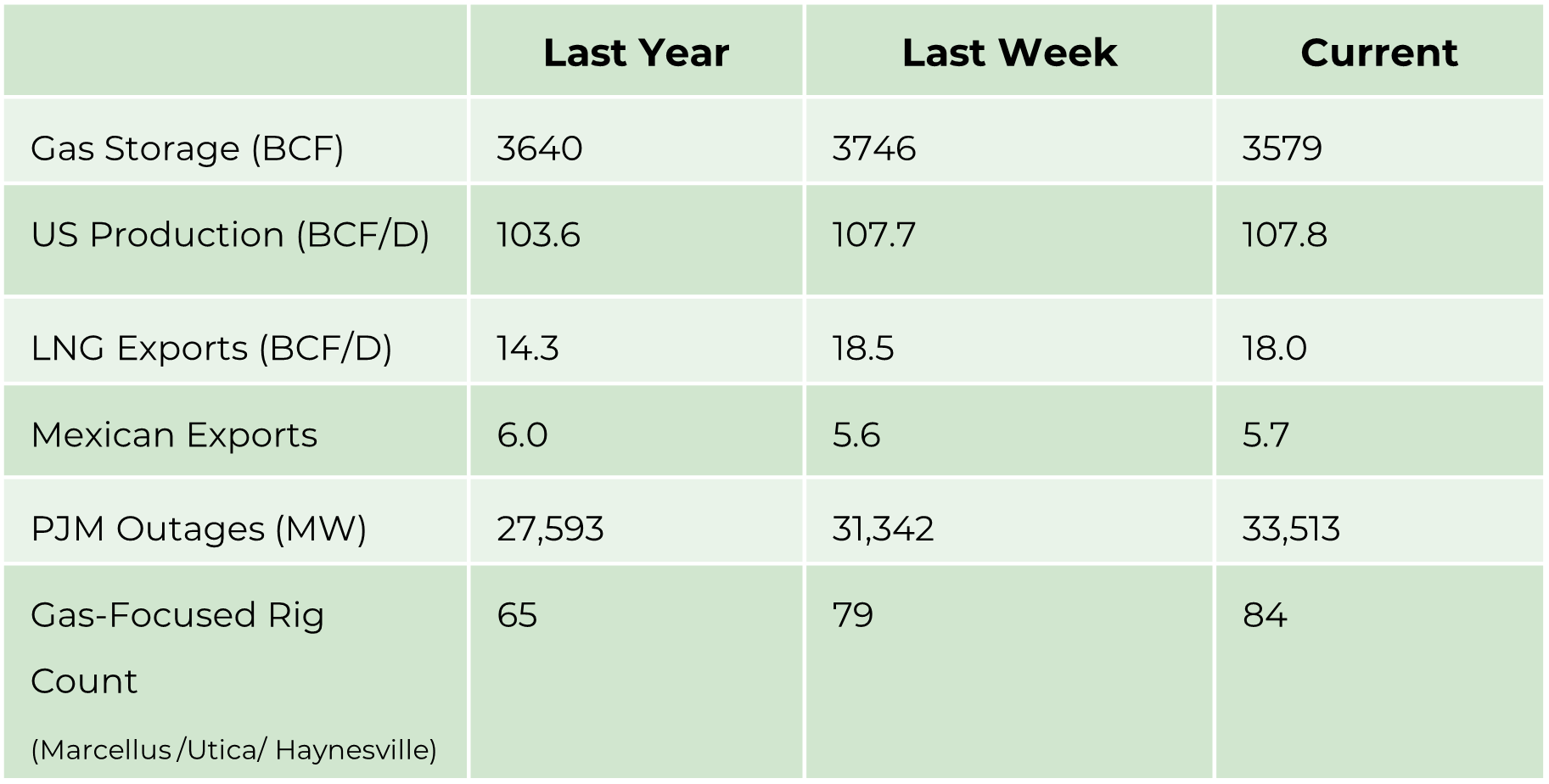

Market Drivers

- Gas Storage/Year over year difference. A positive number is bearish, and a negative number is bullish.

- Production /Year over year growth/trend is important in the context of demand growth.

- LNG Exports/Year over year growth means demand is growing and should be looked at in comparison to production trend.

- Mexican Exports/Add to LNG Exports to show a trend in exports compared to the production trend.

- PJM Outages- generally seasonal in Spring or Fall/Can support short-term prices.

- Gas Focused Rig Count/Is drilling increasing to grow production versus demand growth. This can be seen as impacting price in the future based on expected load growth.

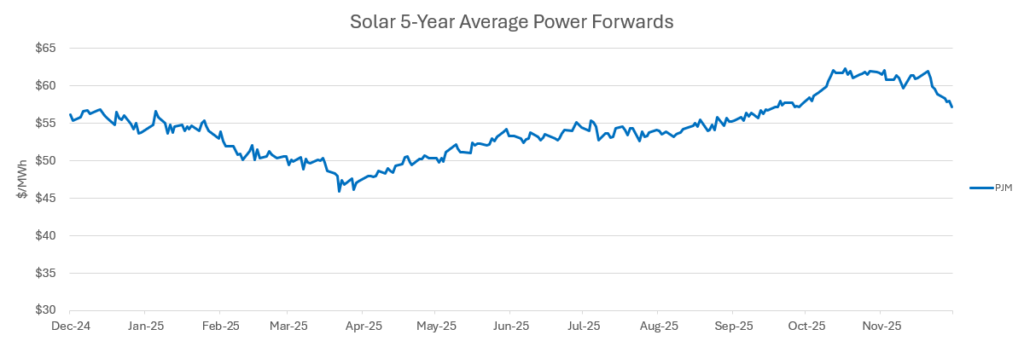

Energy Market Update

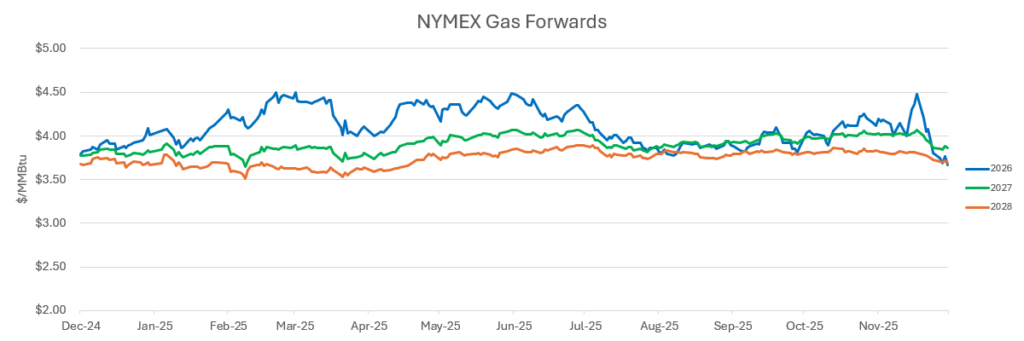

- A massive warm dome expands over the US this week after several weeks of cold, leading to solid storage withdrawals. The January NYMEX rallied up to $5.5/MMBtu and just as fast retreated all the way back below $4.0/MMBtu as the weather forecast confirmed the exit of the cold.

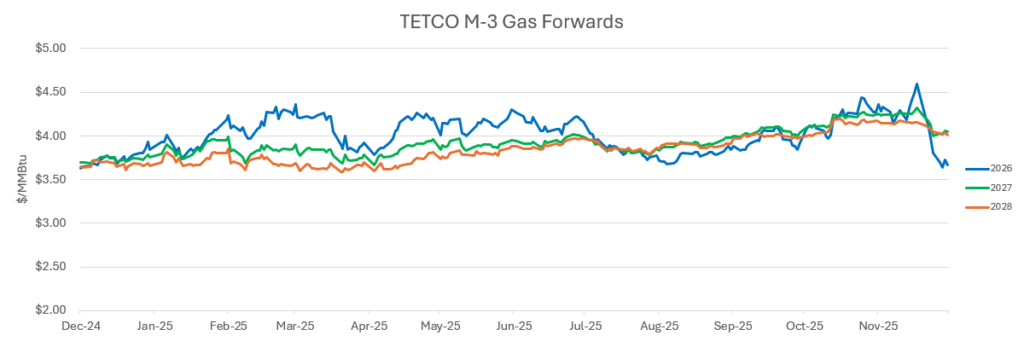

- Transco’s compressor outage on its Leidy system curtailed firm flows into the Northeast markets and caused cash prices to rally to $30/MMBtu for Sunday (12/14), while Algonquin City-Gate prices remain elevated above $10/MMBtu.

- Storage withdrawals through last week’s EIA report put the year-over-year and the 5-year comparison into a deficit, although the upcoming mild weather could reverse that heading into January.

- Oil prices remain under pressure even though an accord between Russia and Ukraine looks elusive, and global demand is strong.

- PJM announced the results of the most recent capacity auction, and as expected, the market cleared all zones at the previously negotiated cap price ($333/MW-day) for the 2027/2028 period. Demand growth continues to outpace generation resources, which is likely to lead to even higher prices in June.

- Global LNG prices have slipped as mild weather in both Europe and Asia significantly decreased demand and left cargoes looking for a home.