July 10, 2025

Upcoming 2026/2027 PJM BRA Auction: Managing Risk in a Changing Energy Landscape

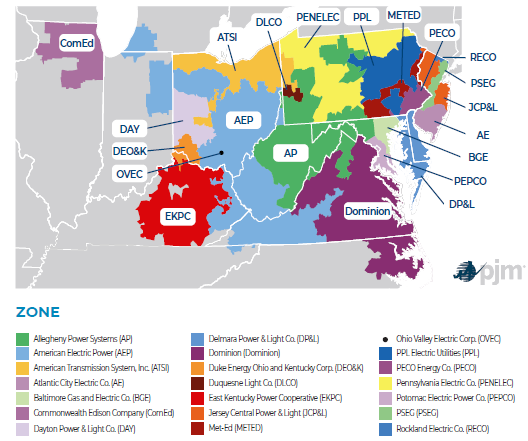

The 2026/2027 BRA opened on July 9, closes on July 15, with results to be released on July 22, and yet there is still a lot riding on the outcome, regardless of the scripted results.

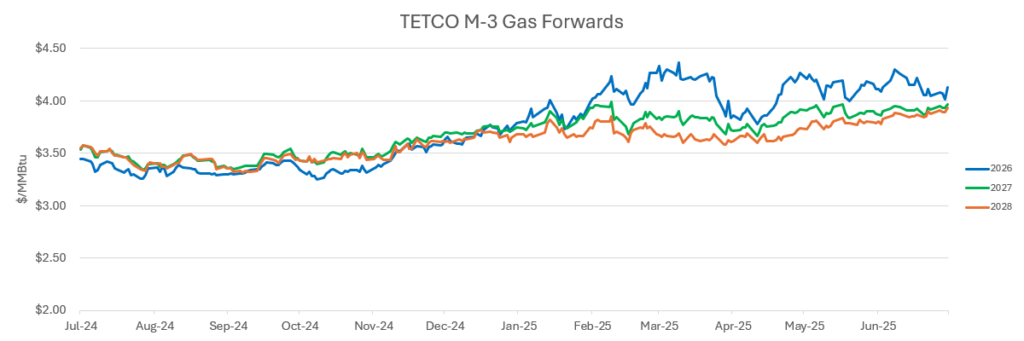

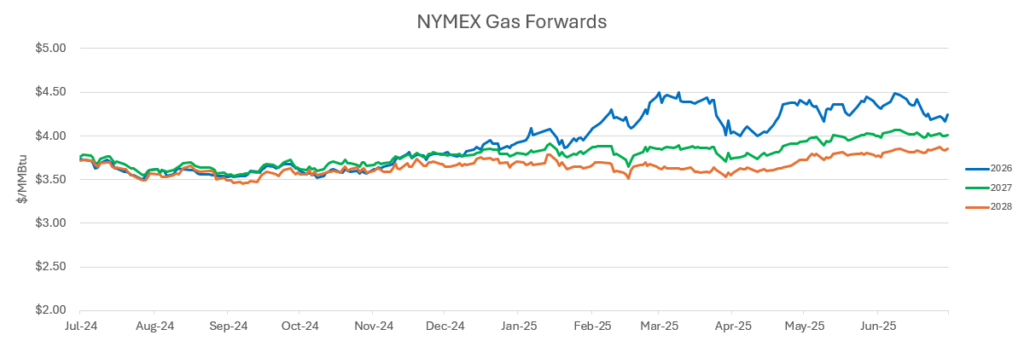

Market Drivers

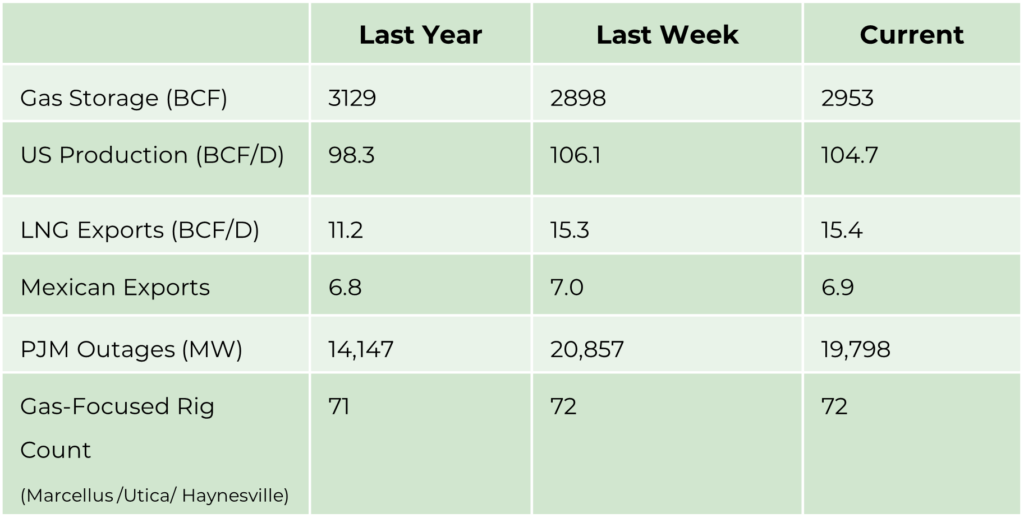

- Gas Storage/Year over year difference. A positive number is bearish, and a negative number is bullish.

- Production /Year over year growth/trend is important in the context of demand growth.

- LNG Exports/Year over year growth means demand is growing and should be looked at in comparison to production trend.

- Mexican Exports/Add to LNG Exports to show a trend in exports compared to the production trend.

- PJM Outages- generally seasonal in Spring or Fall/Can support short-term prices.

- Gas Focused Rig Count/Is drilling increasing to grow production versus demand growth. This can be seen as impacting price in the future based on expected load growth.

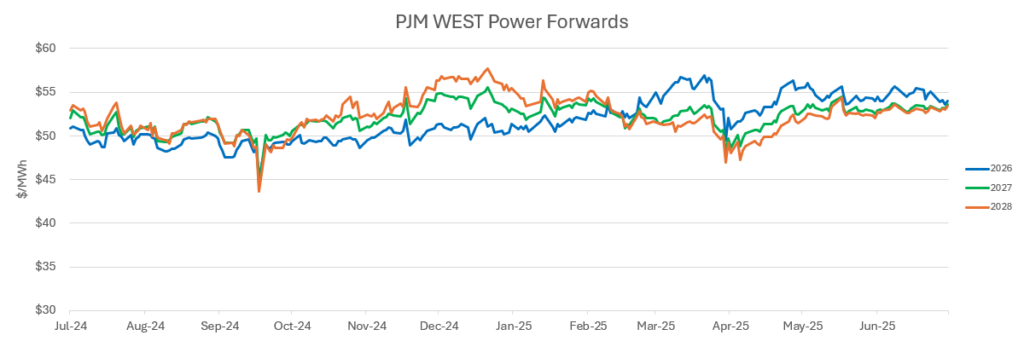

Energy Market Update

- Talen and Amazon expanded their relationship with a long-term power sales agreement committing virtually all the output of the Susquehanna nuclear (1,920 MW) out through 2042 with an extension option. The power will support Amazon’s co-located data center facility in Pennsylvania.

- As summer temperatures in Asia escalate, attracting greater LNG flows to the region, it will be increasingly important for Europe to maintain a robust pace of storage injections to ensure adequate winter preparedness.

- PJM load surpassed 160,000 MW for several consecutive days in late June.

- The former Three Mile Island Unit 1 (now renamed Crane Clean Energy Center) may restart in 2027 (one year earlier than previously announced). The restart is supported by a 20-year power purchase agreement with Microsoft, which will use the electricity to power its data centers.

- Oil inventories have declined for 5 consecutive weeks, supporting demand.

- China’s LNG demand has declined for 8 straight months, impacted by cheaper pipeline gas and increased domestic production.