February 13, 2026

New York’s Grid at a Crossroads: Reliability, Load Growth, and How CPV Retail Can Help

Start spreading the news, CPV Retail has entered the NYISO! With CPV Retail now able to support commercial and industrial brands in meeting their energy needs in New York, we examine the structure of the state’s dynamic grid and the key factors shaping this evolving marketplace.

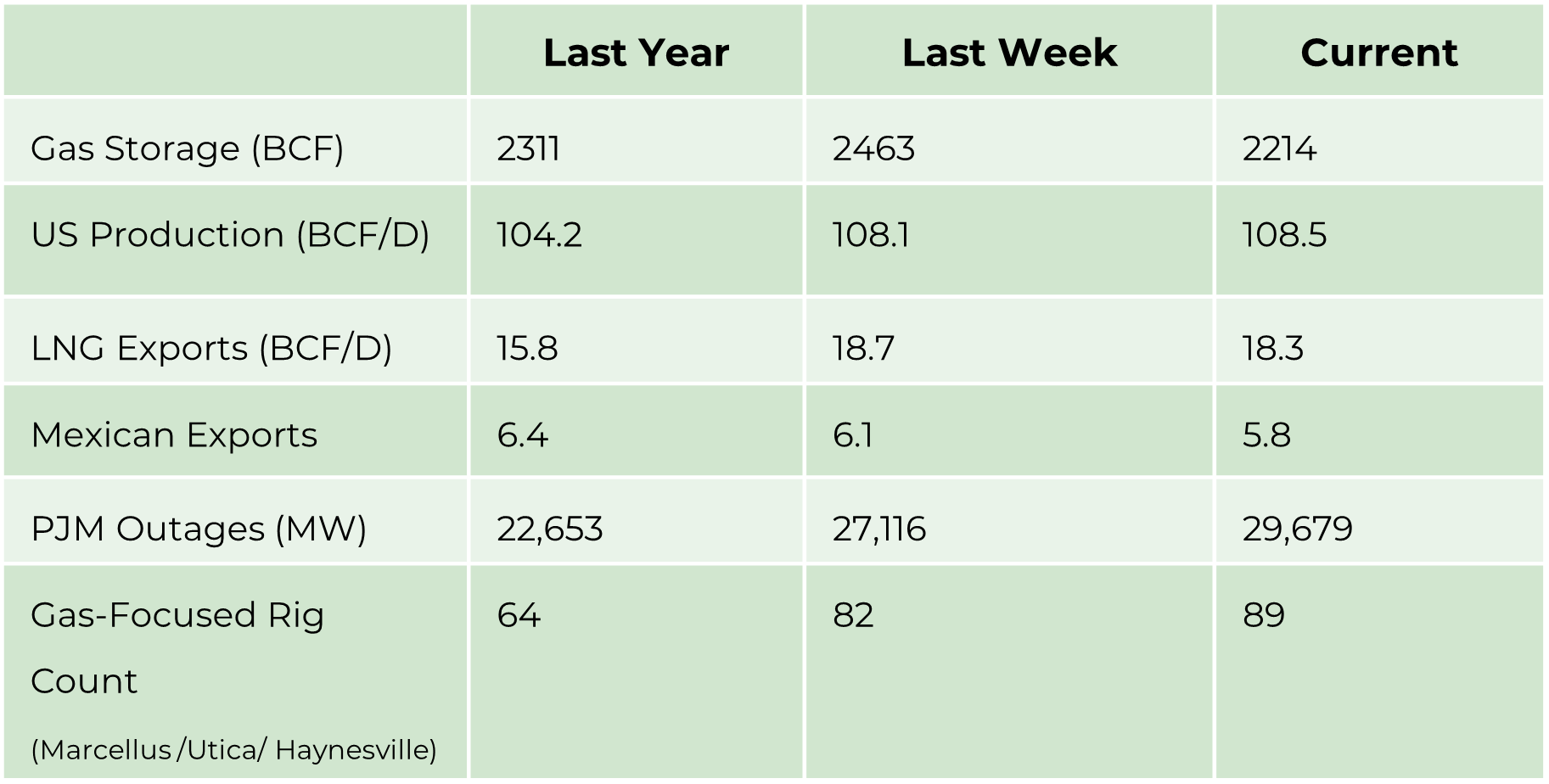

Market Drivers

- Gas Storage/Year over year difference. A positive number is bearish, and a negative number is bullish.

- Production /Year over year growth/trend is important in the context of demand growth.

- LNG Exports/Year over year growth means demand is growing and should be looked at in comparison to production trend.

- Mexican Exports/Add to LNG Exports to show a trend in exports compared to the production trend.

- PJM Outages- generally seasonal in Spring or Fall/Can support short-term prices.

- Gas Focused Rig Count/Is drilling increasing to grow production versus demand growth. This can be seen as impacting price in the future based on expected load growth.

Energy Market Update

- Post–Winter Storm Fern analysis continues as markets digest record demand and extreme price spikes across much of the eastern United States. Iroquois Zone 2 stood out, with transactions reported as high as $300/MMBtu and instantaneous power prices reaching $4,000/MWh.

- The previous weekly storage withdrawal record of 359 Bcf, set in 2018, was surpassed this year by 1 Bcf. Some demand destruction occurred, however, as extended school and government closures reduced peak loads, preventing both power and gas prices from climbing even higher.

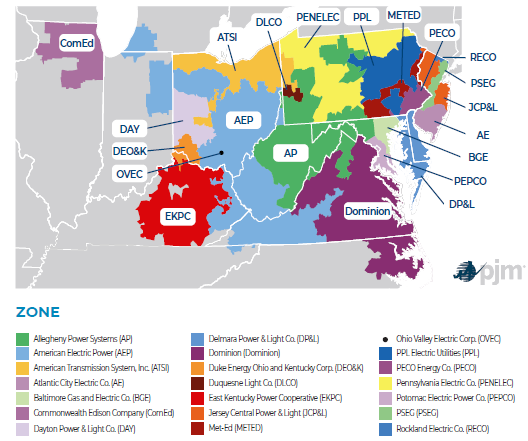

- PJM remains focused on accelerating the development of new dispatchable generation, as urgency around resource adequacy continues to intensify. At the same time, the political sensitivity surrounding rising power prices has grown, particularly as retail customers begin to see the impact of higher bills following the recent cold spell.

- With milder weather now in place, spot prices have retreated sharply from Fern’s peak levels. Northeast gas prices for Presidents’ Day weekend are below $3/MMBtu, while day-ahead power prices are trading under $50/MWh.

- LNG exports have returned to pre-Fern levels after falling by nearly 6 Bcf/d during the height of the cold event. Those export reductions helped stabilize the domestic market, as U.S. gas prices briefly rose above global LNG netbacks, effectively turning export demand into a form of “virtual storage.”

- Continued cold in Europe has supported rapid withdrawals from storage and left inventories at record lows with more cold weather expected. Roughly 80% of US LNG exports have been heading to Europe which will continue through the summer’s re-fill season.

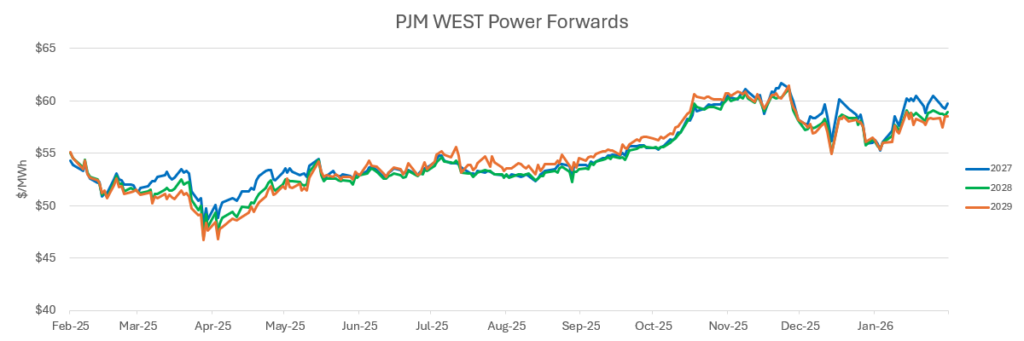

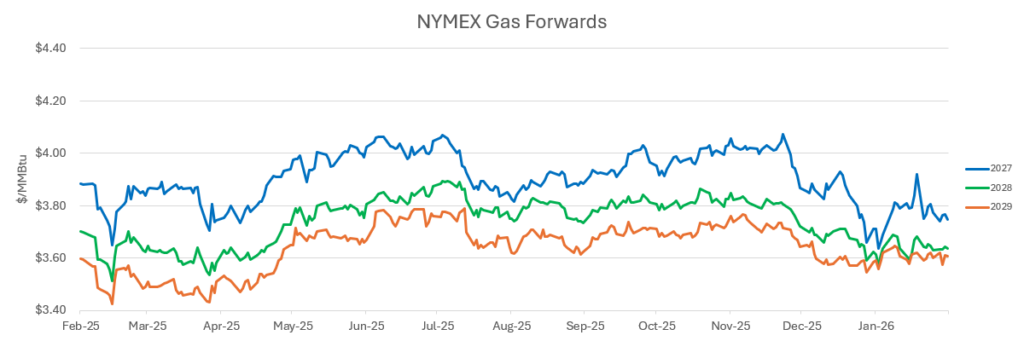

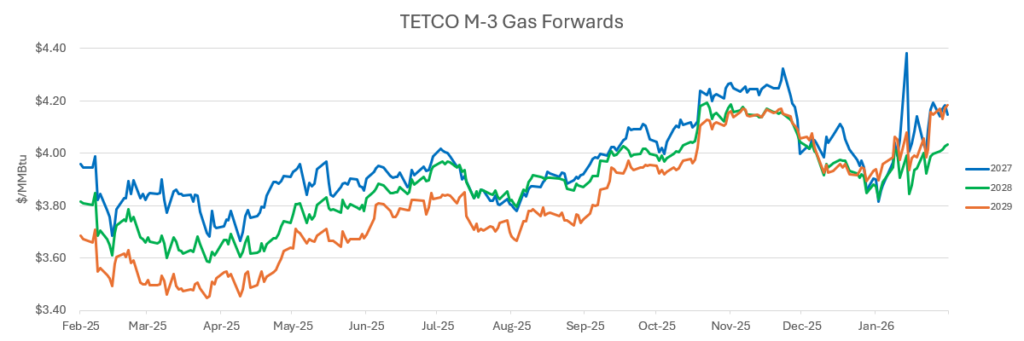

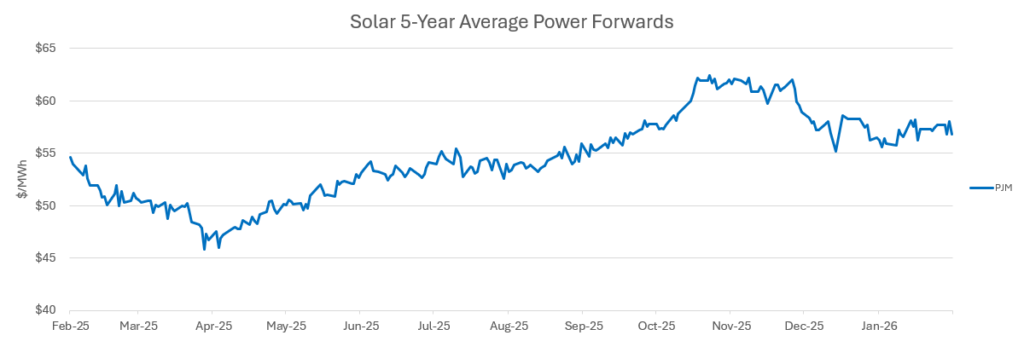

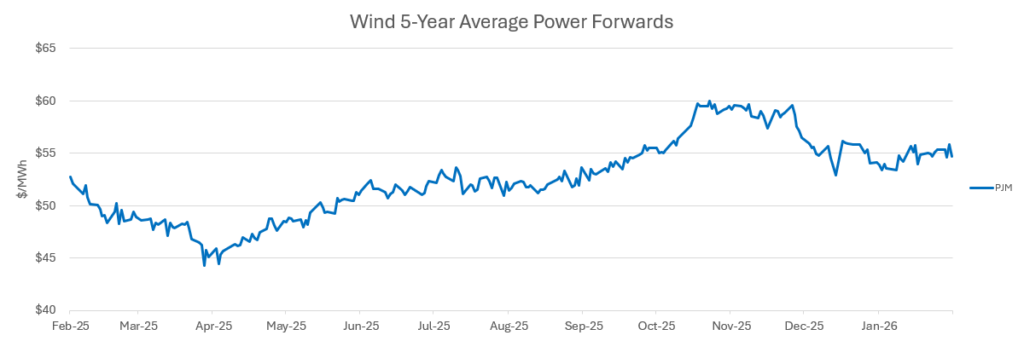

Forward Pricing

References:

https://rpa.org/news/lab/the-state-of-the-grid-in-new-york

https://www.nyiso.com/-/why-the-nyiso-was-created-powering-new-york-future

https://www.nyiso.com/-/podcast-ep.-41-planning-for-multiple-futures

https://www.nyiso.com/-/how-we-keep-the-grid-reliable-in-new-york

https://ferc.gov/introductory-guide-participation-new-york-iso-processes

https://www.amperon.co/ebooks/nyisos-big-test-translating-renewables-into-grid-reliability