New Product Offering

CPV Retail is excited to announce the launch of our new energy transition product – The Carbon Footprint Report.

Whether organizations are just beginning the sustainability journey or have well established climate goals and targets established, CPV Retail Energy as a “Greentailer” is a trusted renewable energy solutions provider. Regardless of where organizations are on the sustainability “learning journey”, or in the energy transition, we are focused on matching our unique set of renewable energy solutions to specific goals and objectives. The old saying “what gets measured gets managed” is especially true when it comes to realizing lower emissions goals. The Carbon Footprint Report is an important first step on this journey.

Please reach out to your contact at CPV Retail Energy for more information or contact us at retailinfo@cpv.com.

PJM Regulatory Review

Additional Agenda Items

- PJM received FERC approval for the proposed changes to capacity accreditation and modeling reforms, whose primary goal is to better understand patterns and likelihood of reliability risk across all 8760 annual hours.

- The approved “modeling enhancement” plan will ultimately revise both the resource adequacy risk modeling as well as the capacity accreditation process. Capacity resources will be subject to more robust testing criteria.

- FERC believes the plan put forth by PJM “will help ensure that PJM’s capacity market design more accurately represents the PJM system’s reliability needs, as well as the expected ability of both individual resources and the fleet as a whole to meet those needs.”

- The genesis of these proposed modifications to the existing methodology came after Winter Storm Elliott almost caused rolling blackouts in December of 2022.

- FERC also believes any incremental costs to consumers will be more than offset by increased reliability.

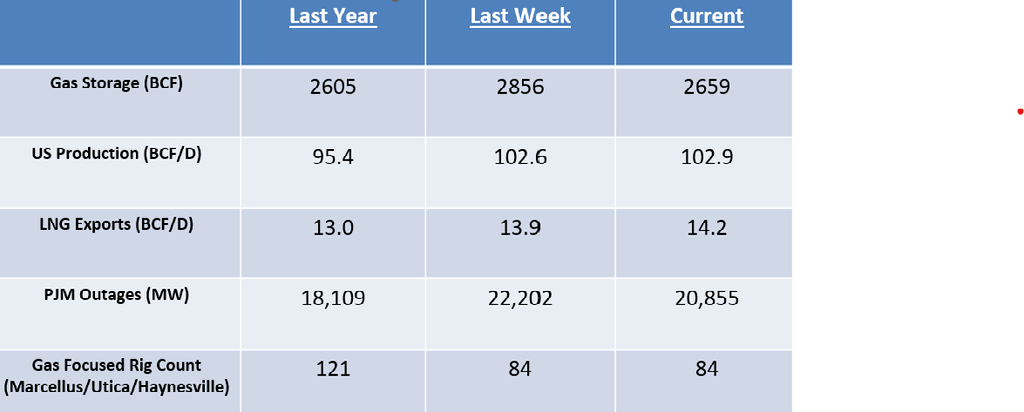

Market Drivers

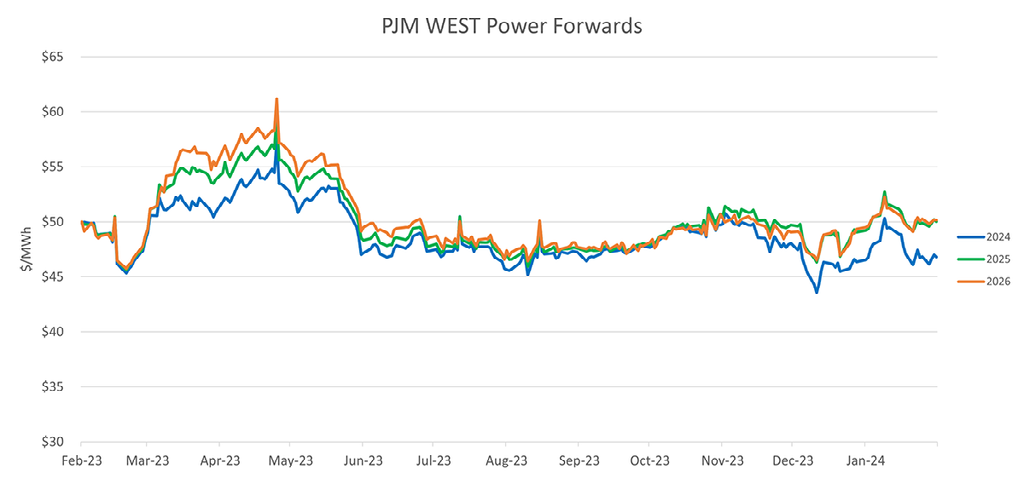

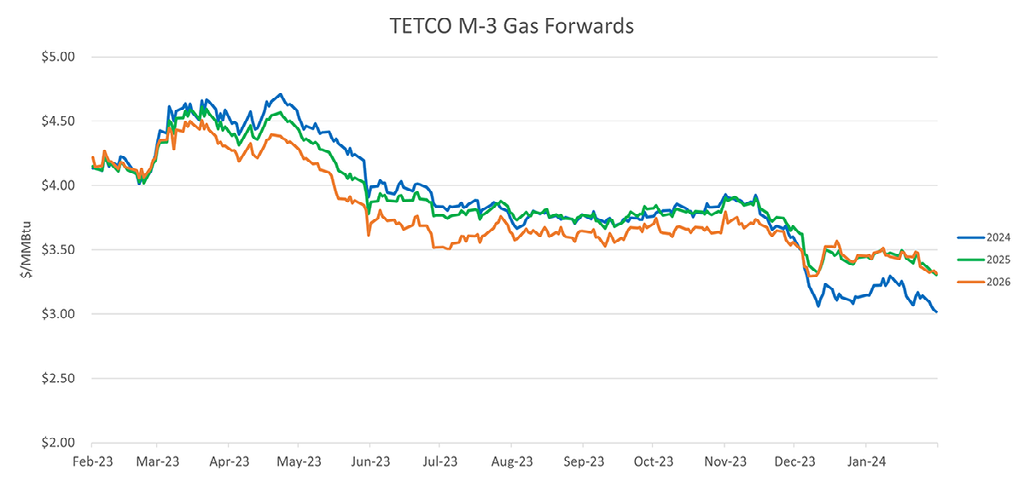

Energy Market Update

- Transitioning From January to February was relatively quiet with the NYMEX settlement coming in just under $2.50/MMBtu as the severe cold has egressed and has now been replaced by above-normal temperatures through mid-February.

- Storage balances in both Europe and North America are still holding above historical levels as the end of the withdrawal season comes into view. Without additional cold weather to incentivize withdrawals, it is likely the excess inventories will continue to put pressure on summer prices.

- Freeport LNG will continue to operate only 2 of the 3 trains as one of the liquefaction units was impacted by the recent Arctic cold temperatures and will require a full electric motor replacement. Each train at Freeport has a capacity of 0.7 BCF/D.

- Oil prices rallied strongly this week primarily on the back of inventory drawdowns at Cushing, Oklahoma. West Texas Intermediate (WTI) is currently priced at $76.5/BBL.

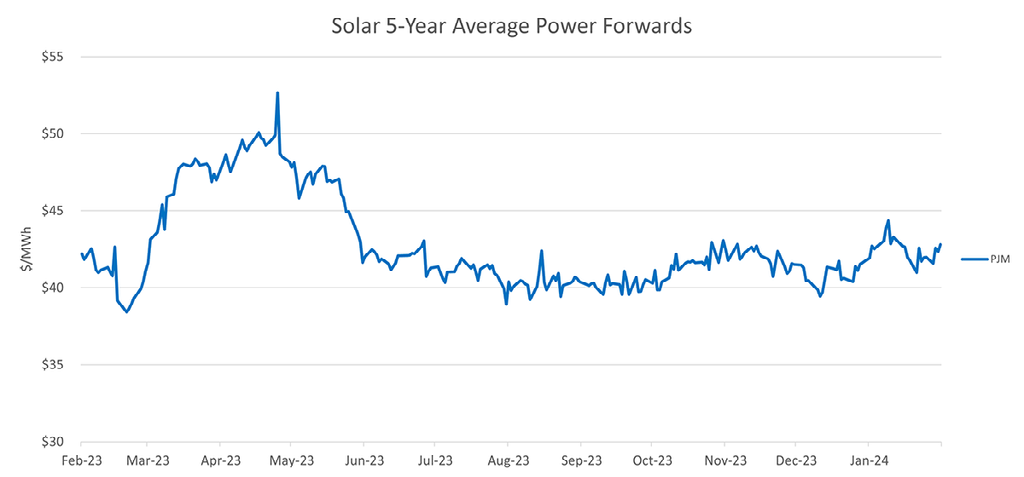

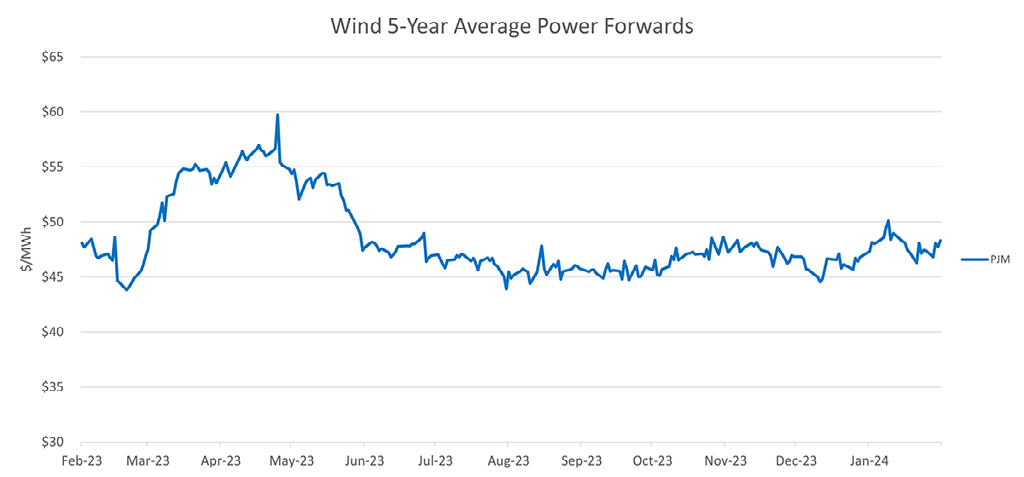

- Solar and wind PPA prices continue to escalate into 2024 after a robust 2023 price increase primarily due to higher interest rates, material costs, labor inflation, and other project-specific parameters.

- Drilling rig utilization continues to maintain stability as producers look for flexibility to keep production relatively flat until 2023. With natural gas prices for March NYMEX marginally above $2.0/MMBTU, further downside pressure in the summer is a distinct possibility without increased storage withdrawals.

Potpourri Comments

The theory that coal as a thermal generating fuel does not have a future, unfortunately, flies in the face of reality and the energy security focus of the two largest coal generators in the world.. India and China. Both of these countries continue to build out coal-generating capacity at an unbelievable pace as electricity demand continues to accelerate.. Particularly in India. China led the growth in GDP over the last 20 years and India is picking that mantle up and running with it. They are seeing double-digit % growth in electricity demand and given the lack of natural gas infrastructure and cost coal is the fuel of choice as India tries to manage the needs of 100’s of millions of new consumers. Both India and China are also producing prodigious amounts of coal as well as importing the balance of their requirements. China has fueled the economic growth in Australia in pretty much all commodities including LNG and coal. While the United States will retire another tranche of its operating coal fleet over the next 5 years the rest of the world continues to build out capacity and utilize coal as the primary thermal generating fuel. Renewables are being utilized in addition to the aforementioned thermal resources but given the two primary motivations of both countries are security of supply and economics do not expect coal to fall out of the stack any time soon. When it comes to supply and making the best economic choice for your power needs please reach out to your CPV Retail Team and let us design a program through a collaborative process with you!