New Product Offering

CPV Retail is excited to announce the launch of our new energy transition product – The Carbon Footprint Report.

Whether organizations are just beginning the sustainability journey or have well established climate goals and targets established, CPV Retail Energy as a “Greentailer” is a trusted renewable energy solutions provider. Regardless of where organizations are on the sustainability “learning journey”, or in the energy transition, we are focused on matching our unique set of renewable energy solutions to specific goals and objectives. The old saying “what gets measured gets managed” is especially true when it comes to realizing lower emissions goals. The Carbon Footprint Report is an important first step on this journey.

Please reach out to your contact at CPV Retail Energy for more information or contact us at retailinfo@cpv.com.

PJM Regulatory Review

Additional Agenda Items

- PJM along with several other prominent RTO’s provided briefs to the US EPA emphasizing the importance of reliability versus a more dogmatic approach to recent environmental regulations and fossil fuel power plants. ERCOT, SPP, MISO and PJM asked for a sort of “reliability safety valve” which under emergency conditions would allow states flexibility to ensure reliability.

- A letter supported by multiple entities was sent to the PJM Board which supported efforts to “undertake a comprehensive and unbiased examination of alternative market constructs before entering into consensus building or reaching a decision point that requires stakeholders to select a market design to develop in the next phase of resource adequacy reforms.”

- FERC recently approved the uncontested settlement related to the Winter Storm Elliott complaints which reduced the total penalty amounts by approximately 33%. ($1.8 billion to $1.2 billion)

- The Ohio Manufacturers Association (OMA) expressed in a letter to the PJM Board its continued support for competitive markets while also opining on grid reliability concerns.

Market Drivers

Energy Market Update

- Both oil and natural gas production in the United States are setting records with oil production running about 13.2 million barrels/d and gas production pushing up near 105 BCF/D. These robust figures make the US the undisputed global leader in energy exports at a time when international shipping concerns in the Middle East are percolating.

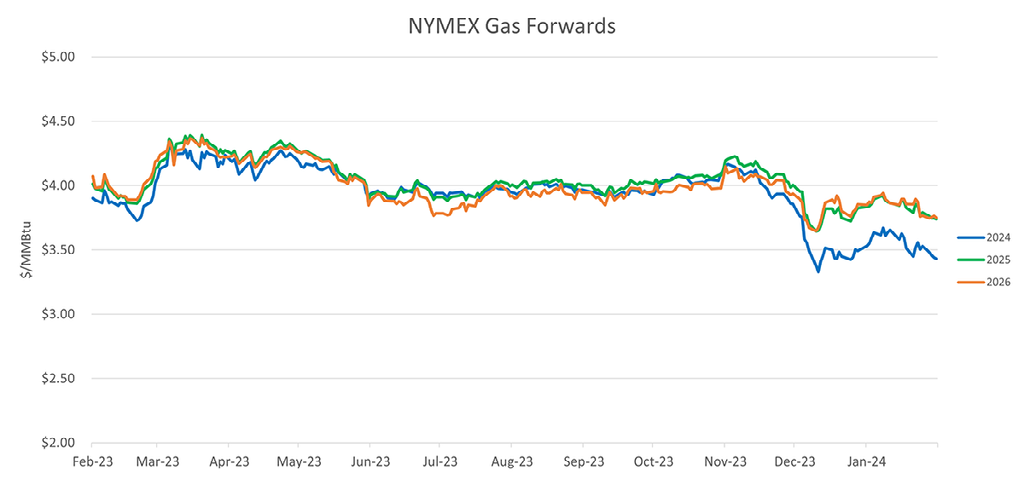

- After the recent across the board selling of natural gas out through 2031 prices look to have stabilized albeit at much lower levels due to global storage balances still resting at all time highs for a January. The question remains as to whether there will be sufficient calendar duration coupled with cold weather to sufficiently deplete storage balances prior to heading into the spring.

- Without a return to “normal” temperatures soon the storage operators could be faced with forced withdrawals or ratchets which would exacerbate the excess supply situation the North American gas markets currently face. Both the United States and Canada are currently facing a year-over-year gas inventory surplus approaching 750 BCF which could create congestion issues later in 2024 unless production starts to decline.

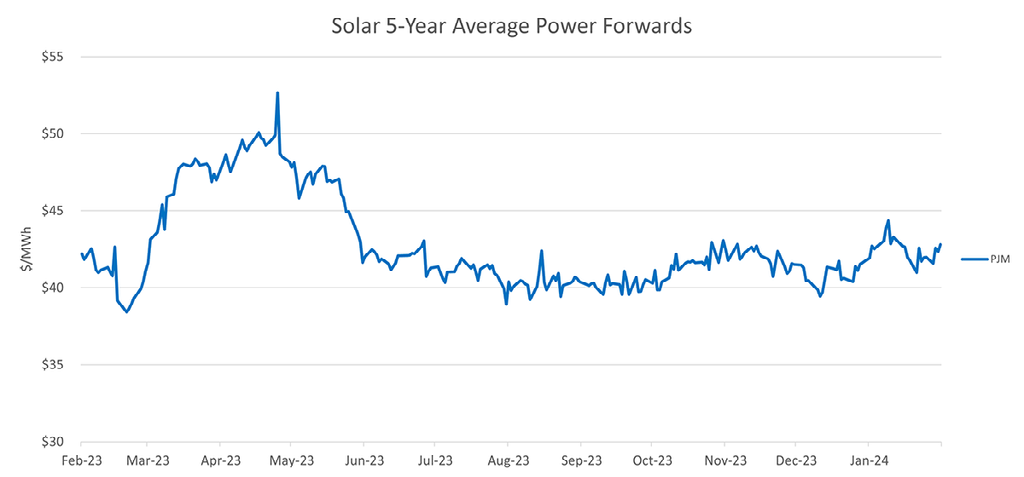

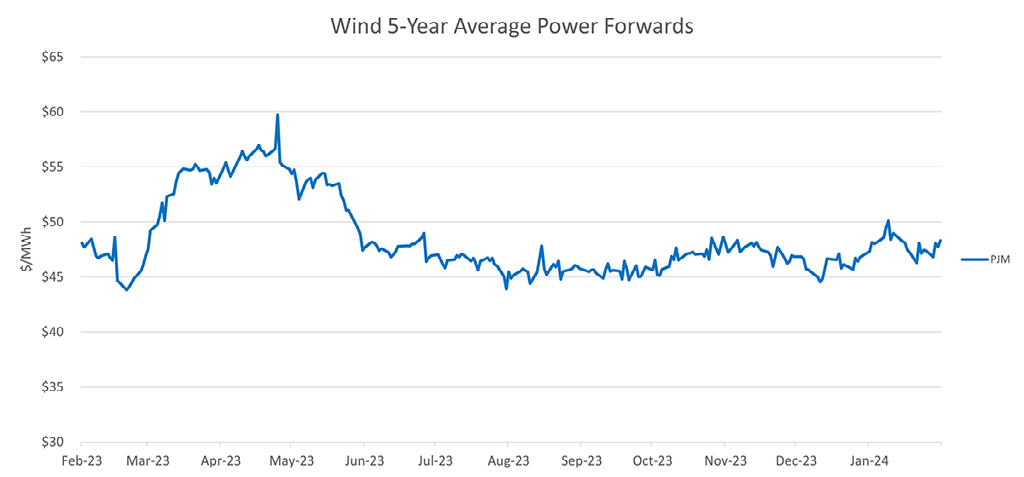

- Wind and solar installations continue to advance rapidly and could start to create pressure against coal and natural gas generators even as the next phase of fossil retirements begin.

- PJM has published an updated peak load forecast which concludes that data center driven demand growth will push PJM’s peak load towards 180,000MW in ten years. Intel’s new microchip processing plant outside Columbus will also contribute to load growth projections.

- The interconnection queue process in PJM seems to be improving as 300 generation projects are expected to clear in 2024. The interconnection process reform was necessitated by a large backlog of primarily renewable projects coupled with supply chain issues.

- LNG demand growth continued in Asia as cold weather boosted demand in the three major markets of Japan, Korea and China. Demand for the frozen fuel increased by about 6% in December with South Korea leading the procurement efforts.

Potpourri Comments

2024 is setting itself up to be pivotal for many reasons as the global backdrop of uncertainty only continues to grow. The United States has a critical presidential election in November at a time when crises abound overseas and the energy markets remain in a transitional phase. With ships now being attacked daily proximate to the transit zones of critical oil and natural gas shipping lanes the US ability to protect the interests of itself and its friends is being put to the test. The war in the Ukraine has not diminished in violence as the recent hyper-sonic weapon attack in Kiev clearly manifests while nobody knows how the Israeli’s plan on building out buffer zones of enhanced security. The election in the United States will have a dramatic impact on how many of these sagas will ultimately shake out given the divergent philosophies of the respective parties running candidates. Additionally, will there be a viable 3rd-party candidate that can actually win and/or split the vote of the 2 major party candidates. Energy policy, like pretty much all other issues are addressed by the two likely candidates in diametrically opposite ways. It is a long way until November and the path from now until then is fraught with potential pitfalls both domestically and internationally. The calm amongst all the swells comes from your ability to avail yourself of the experts here at CPV Retail who are all ready to help manage your energy procurement needs. Let us help you maneuver through all this uncertainty and design an energy procurement program with flexibility and creativity.